working capital turnover ratio calculator

Information about your total liabilities and your total assets can typically. It is very easy and simple.

Inventory Turnover Formula Analysis And Ratio Calculator Excel Template

How to Calculate your Working Capital Turnover Ratio.

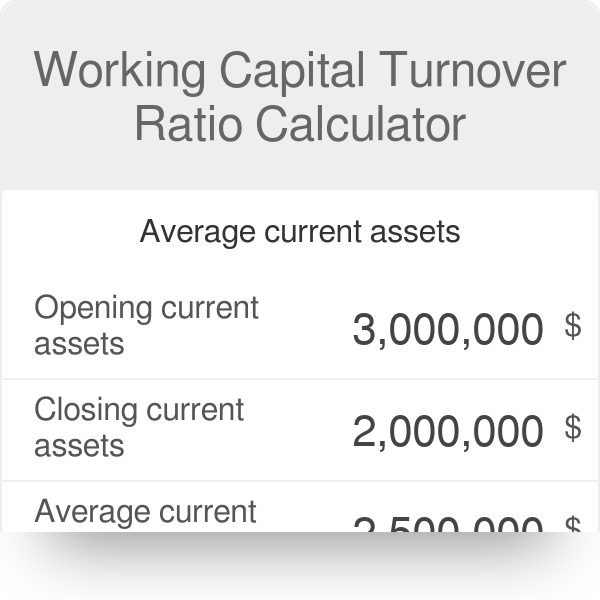

. First lets calculate the average working capital. Working capital can be calculated by. Working capital turnover ratio.

Working capital turnover is a measurement comparing the depletion of working capital used to fund operations and purchase inventory which is then converted into sales. Ad Compare Top 7 Working Capital Lenders of 2022. The working capital turnover ratio calculation ignores disgruntled employees or economic downturns both of which can have an impact on a companys financial health.

About Working Capital Turnover. Now that we are aware of what Working Capital and Turnover are we can understand the Working Capital Turnover Ratio. You need to provide the two inputs ie.

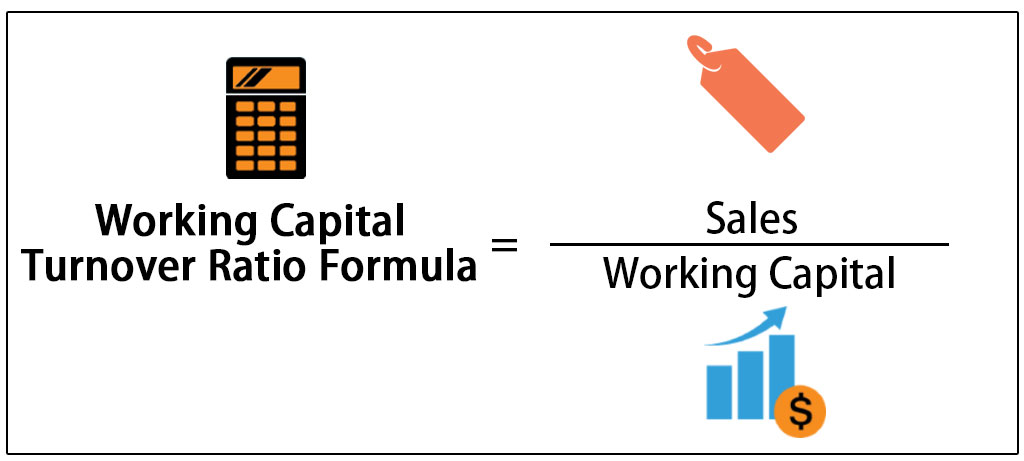

What is the working capital turnover ratio for Year 3. WC Turnover Ratio Revenue Average Working Capital. Since we now have the two necessary inputs to calculate the working capital turnover the remaining step is to divide net sales by NWC.

The CA and CL amounts are found on your companys balance sheet. Working capital is calculated by subtracting a companys total liabilities debts from its total assets. Now working capital Current assets Current liabilities.

The formula to measure the working capital turnover ratio is as follows. The working capital turnover ratio is an efficiency metric that measures how effectively a business turns its working capital into increased sales numbers. Working Capital Turnover 190000 95000.

Calculate working capital by subtracting current liabilities from current assets. Once you know your working capital amount divide your net sales. WC dfrac 100 000 180 000 2 140 000 latex Now we can calculate the working capital.

The calculation would be sales of 320000 divided by average working capital of. Apply Now Get Low Rates. Working capital is the difference between current assets CA and current liabilities CL at a specific date.

A high working capital turnover ratio indicates that. An online financial calculator for net working capital turnover calculation which is defined as the ratio of net sales to working capital. You can easily calculate the Working Capital using the Formula in the template.

100000 40000. The working capital turnover ratio is an efficiency metric that measures how effectively a business turns its working capital into increased sales numbers. The Working Capital Turnover ratio measures the companys Net Sales from the Working Capital generated.

Putting the values in the formula of working capital turnover ratio we get. If your organization has 500000 in current assets and 300000 in total current liabilities your working capital is 200000. The working capital turnover ratio.

Current Assets and Current Liabilities.

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Formula And Excel Calculator

Working Capital Turnover Ratio Formula Calculator Excel Template

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

Asset Turnover Ratio Formula Calculator Excel Template

How To Calculate Ppe Turnover Avetta

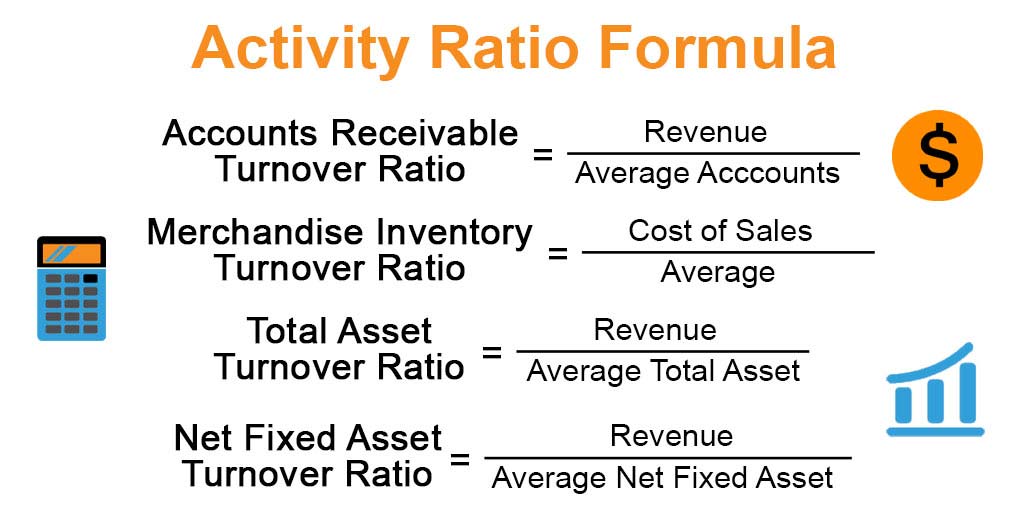

Activity Ratio Formula And Efficiency Calculator Excel Template

Activity Ratio Formula Calculator Example With Excel Template

How To Calculate Working Capital Turnover Ratio Flow Capital

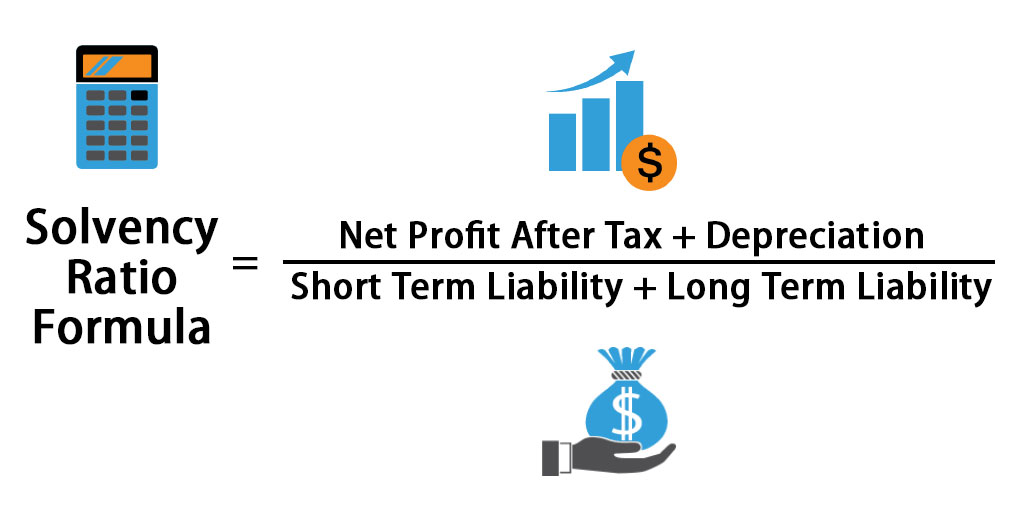

Solvency Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Formula And Excel Calculator

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

How To Calculate Your Working Capital Turnover Ratio

Asset Turnover Ratio Formula And Calculator Excel Template

Working Capital Turnover Ratio Calculator

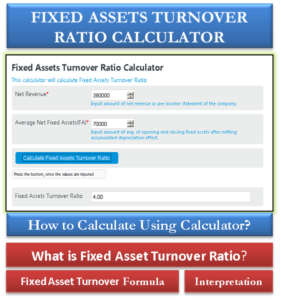

Fixed Asset Turnover Ratio Calculator With Formula Interpretation Efm